Advances In The Cloud, Security Technology

August 5, 2016

Cyber Security’s Growing Importance

August 12, 2016This article originally appeared on Lexology, a source of news for Globe Business Media Group.

Jonathan Cohen, one of my partners at Wilkinson Barker Knauer LLP, has been closely following theincentive auction by which the FCC is looking to clear a significant part of the television band and take that spectrum, slice it up into different size blocks, and resell it to wireless companies. He has been guiding numerous companies through its complexities. We’ve written much about the auction onthese pages, and now Jonathan offers these observations about the auction. – DDO

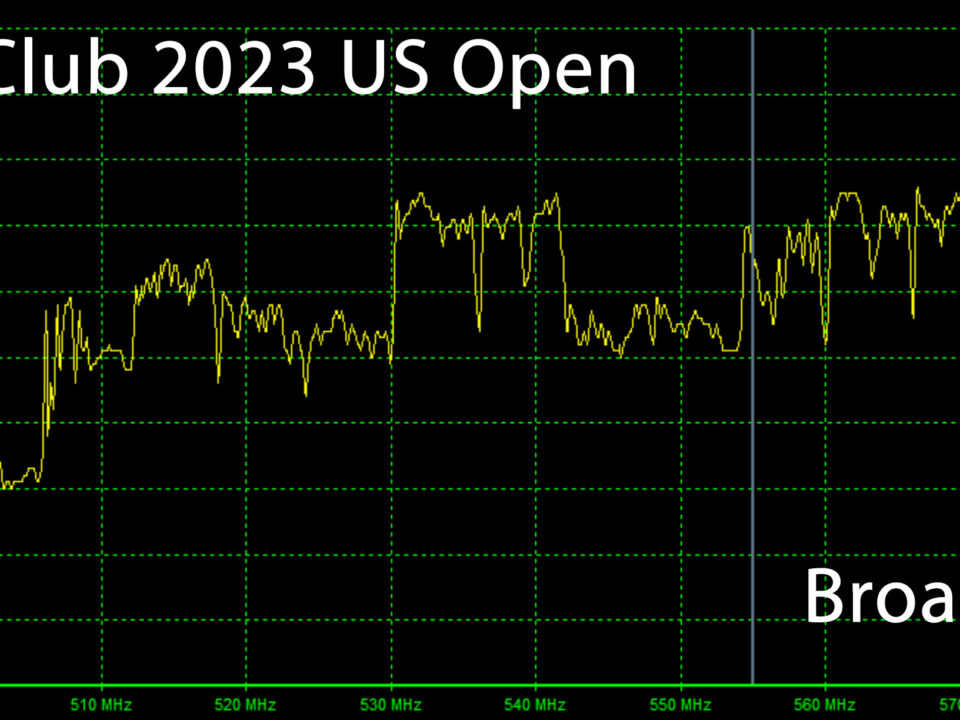

With the FCC’s Incentive Auction poised to move into its next phase with the August 16th start of active bidding in the forward auction, where companies looking to provide mobile broadband services will bid on licenses carved out of the spectrum vacated by TV broadcasters, we thought it might be helpful to address a few of the myths that seem to be floating around about the auction.

Myth: In the initial stage of the reverse auction, broadcasters were greedy, demanding that the government pay $86.4 billion for their spectrum.

Reality: This line of thinking demonstrates a fundamental misunderstanding of the way the Incentive Auction was designed to work. In each round of the reverse auction, the FCC makes price offers to TV stations, who decide whether or not to accept them. Not the other way around. The FCC decided to set opening price offers at very high levels. The highest opening “go off-air” price offer was $900 million (for a station in New York City), but nine-figure opening offers were plentiful, including to a station in Ottumwa, Iowa (DMA #200).

These high prices apparently encouraged a lot of stations to make the initial commitment to accept its opening price offer, which led the FCC to try to clear 126 MHz of spectrum in the initial stage – the most the rules would allow. Under the FCC’s auction design, as prices decline, a TV station can reject the FCC’s offer at any point, but the FCC can continue to reduce its clearing price offers to a station still in the auction only as long as it was still feasible to repack that station given all the other stations that would remain in operation after the auction.

At the 126 MHz clearing target, only channels 14-29 are available in the repacked UHF band, and this apparently caused the auction prices for many stations to “freeze” at high levels (once it was determined that a station could no longer be repacked), resulting in the $86.4 billion total clearing cost announced at the end of June. For all we know, however, a great many TV stations that are now possible “winners” in the reverse auction might have been willing to keep accepting price offers below their frozen prices. It was the auction design – freezing station’s buy-out prices when that station could no longer be repacked – that set the prices, not the broadcasters.